Dont trust those flyers or ads. Those are all new constructions and builders are trying their level best to drag people into stupid deals.. You want real prices, look at realtor.ca. Also given the situation right now, there is a massive scope of some aggresive negotiation.

I purchased my place for a price even less than its 2019 assessment because I pushed them hard over a period of 2-3 months while they kept on doing open houses after open houses with no offer even after price drop.

It is note worthy that I failed in this tactic atleast 10-15 times before I succeeded. But then I was never going into the market to buy now. I wanted to buy at the best price I could get.

I dunno where your workplace is, but I assume it is in downtown, by choosing the right location, even port moody or coquitlam is less than 30-40 minutes journey in west coast express. Very reliable and very comfortable journey. Plus you have skytrain as back up as well. Coquitlam has some great schools to boot.

Even in vancouver proper, there are some decently priced places for that kind of income.

And you can also look at burnaby too.

https://www.realtor.ca/real-estate/26380371/58-6528-denbigh-avenue-burnaby#view=neighbourhood

https://www.realtor.ca/real-estate/26396845/130-6588-southoaks-crescent-burnaby

https://www.realtor.ca/real-estate/26085967/6-1263-w-8th-avenue-vancouver#view=neighbourhood

https://www.realtor.ca/real-estate/26382584/4795-slocan-street-vancouver#view=neighbourhood

https://www.realtor.ca/real-estate/26357487/186-james-road-port-moody

https://www.realtor.ca/real-estate/26396313/276-balmoral-place-port-moody

https://www.realtor.ca/real-estate/26155401/1-6391-cooney-road-richmond

I'm not in downtown, much closer to Burnaby. Those are townhouses, and I personally am looking at detached houses. I don't like being too close to neighbors, and I'm wary of townhouses/condos, I know someone who was prohibited to install air-conditioning during the summer due to some shared insurance issue. And yes, I am looking at brand new one, not interested in buying used. If I'm getting a house, it's because I plan to settle there long-term, and I'm not trying to flip it.

The typical tactic that is suggested is called "Climbing the housing ladder". You start with a 1 bedroom condo before marriage when you moved out of college in the job -- may be with some help from mom and dad. Then you find a partner, hopefully not a total bum and get married. For few years your 1 bedroom is enough. Then you move to townhouse by selling the 1 bedroom condo and using proceeds as downpayment for townhouse. Have a kid or two in next 4-5 years. Then sell townhouse and move into a house.

Anyhoo, I come from India and in Mumbai, the equivalent of Vancouver for India, families live in condos very typically and in small condos to boot. Famously, one of the highest paid cricketer in India grew up in a condo and I believe till some point used to live there even after getting rich. I heard same is in Tokyo. So in these costly places, condo life is very common.

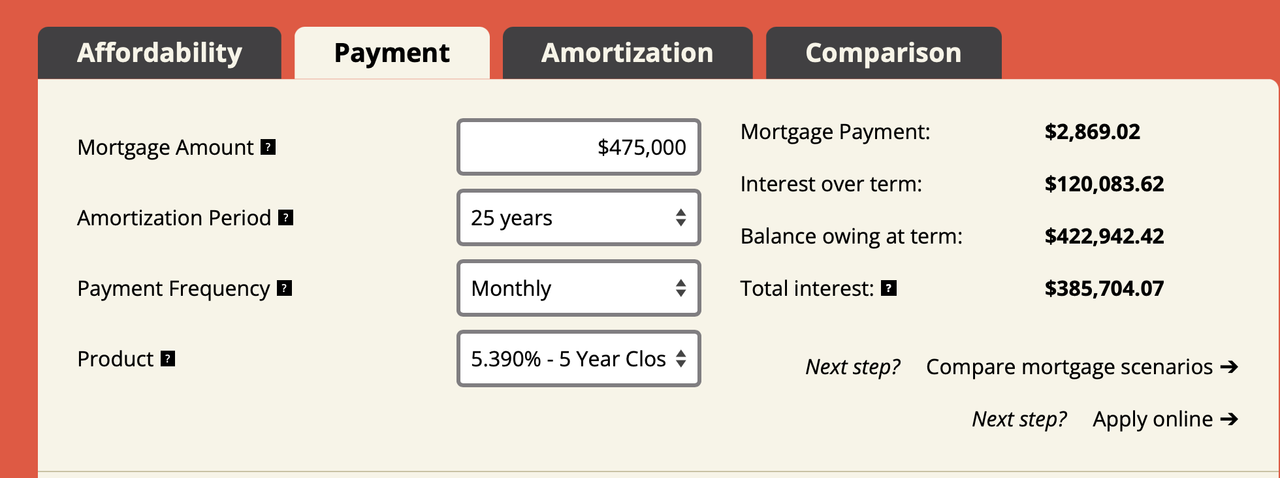

Maybe it's just me, but I feel that's a more expensive way of doing it. If I get into a mortgage, then I'll be paying interest which is a net negative, wouldn't it be better to just stick to rentals and let the money grow in equities? Especially at these interest rates. Some of my co-workers, who accumulated multiple small properties are renting it out, while that would definitely generate income, it's starting to look more like a business than an investment. Other people I know, are simply moving further out like Maple Ridge, Pitt Meadows or Langley.