Hello Guys.

I did my short landing 5 days ago and i opened the bank account within RBC Bank. Yesterday, I received the envelope from the bank with Declaration for Tax Residence form on my friend's address in Canada. Issue is I am not planning to come back to Canada in the next 4 months, since I am still working in Dubai and have a notice period to serve. I don't have PR Card yet, so technically, I cannot be considered as Permanent Resident too. Also, Dubai is a tax-free country.

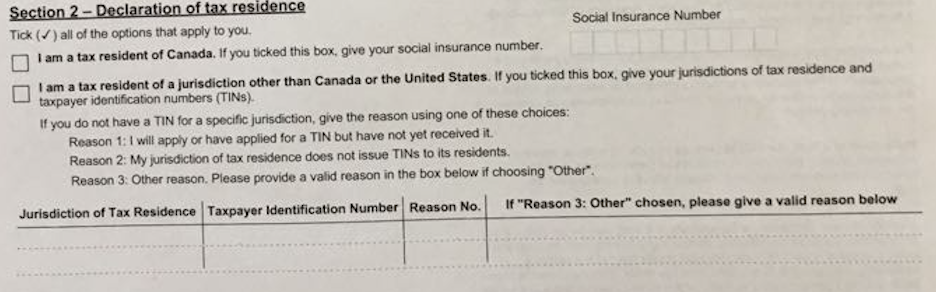

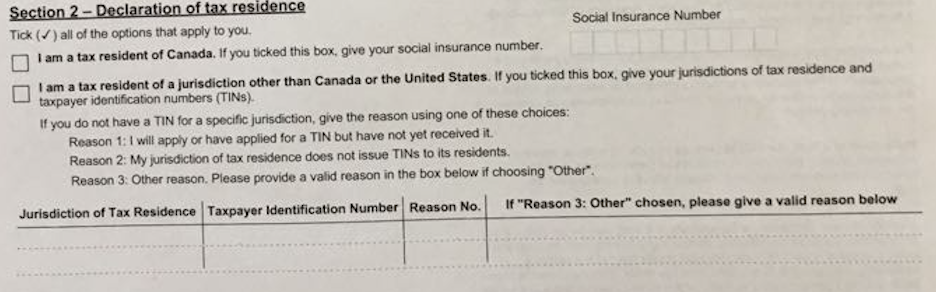

I wonder what exactly I need to mention in the form's section 2. Any ideas?

I did my short landing 5 days ago and i opened the bank account within RBC Bank. Yesterday, I received the envelope from the bank with Declaration for Tax Residence form on my friend's address in Canada. Issue is I am not planning to come back to Canada in the next 4 months, since I am still working in Dubai and have a notice period to serve. I don't have PR Card yet, so technically, I cannot be considered as Permanent Resident too. Also, Dubai is a tax-free country.

I wonder what exactly I need to mention in the form's section 2. Any ideas?